Zomato, earlier known as Eternal Limited, which is the now organization in the e-commerce industry of India, is amongst the exponents of the country’s food delivery business. The decision to rebrand from Zomato to Eternal by the company’s leaders is, in fact, not only a superficial alteration but reflects moreover a decisive transition towards a more diverse portfolio that will include food delivery, quick commerce, live events, and B2B supplies.

However, this shift of direction to a multi-service company entails challenges that question the company’s ability to go through the testing process in terms of being resilient and adaptable. The completely new name for Zomato came into play when the company was referred to as Eternal Limited on their rebranding day.

The Rebranding: A Strategic Pivot

Last March, Zomato unveiled a new face, Eternal Limited, to the public, a move that was perceived as the company’s aspiration to do the beyond just food delivery. The intention behind the decision was to consolidate Blinkit quick commerce, District live events, and Hyperpure B2B kitchen supplies as one entity or rather one family.

However, even though the Zomato app's brand name hasn't transformed and it continues to work the old way, the renaming of the holding creator definitely outlines an extended spectrum.

Financial Turbulence Amidst Expansion

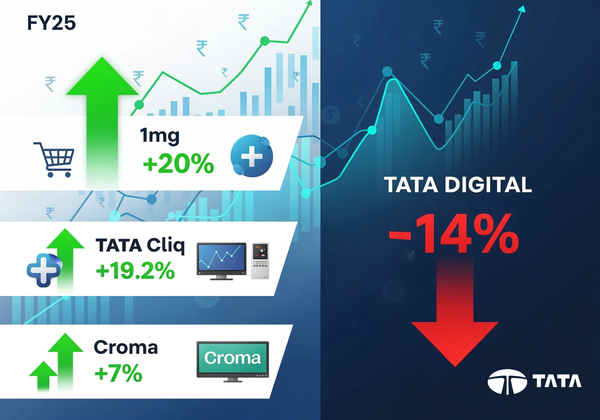

The Q4 FY25 financial results for Eternal Limited show a more ambiguous situation. In contrast to a 64% revenue growth (year-on-year basis) crossing ₹5,833 crore, the net profit dropped to ₹39 crore, a 78% reduction.

Such a decrease is mostly due to the significant amount of money that was invested in Blinkit, because even though its revenue figure was doubled to ₹1,709 crore, its core loss-adjusted of ₹178 crore could not be reversed

Food Delivery: A Mature Market Facing Headwinds

The core food delivery business of Zomato recorded a 17% growth in yearly revenues as the company hit ₹2,409 crore. Nevertheless, this figure was still lower than the company's 20% estimated growth rate.

Among the challenges that the company faced were slow customer demand, competition from quick commerce, and a shortage of distribution points that all affected the business.

The company registered the removal of 19,000 eateries from its directory due to hygiene and compliance reasons which further cut the order volumes downward with the corresponding link to the news provided for you to check out.

Leadership Reshuffle Amidst Strategic Realignment

The company underwent a lot of transformations in relation to its leadership as Rakesh, on the one hand, the recent fall in profits has not dampened the spirits of investors.

Morgan Stanley has affirmed that it is quite positive about the future of Eternal and has hence set a new share price goal of ₹320 while the company is pointing to the last quarter earnings being strong and equity dilution almost gone.

A huge transaction in the market led to the French bank BNP Paribas purchasing ₹1,484 crore worth of shares signaling still the interest of the investors.

Directional Signal: Growth, But Mind the Business

Eternal's experience is a representation of the hardships involved in expanding the business along with fierce competitors and fast-growing trends that made it difficult. The company's success in managing multiple business ventures simultaneously, and generating revenue from them will decide its future course.

As incarnating this transformative stage, the judgment taken by the company will not only be a significant factor for its own development but also a model for the digital commerce landscape in the country.

A Continuous Struggle

Amidst the looming deadline, Eternal is contemplating their options while dealing with the thorny issue of complexity in Zomato's operations. Every decision the players make seems like a game of chance where the stakes are not only the financial but also the loss of reputation and the effects on their future.

As they go through the suggested solutions, balancing the gains versus the losses, the heat beneath their feet is steadily increasing. The belief the team have in their creativity and their relentless spirit is keeping a flame of possibility that they can gauge the market despite the conditions. It's a race with time, however, Eternal has the power to do the right thing even at a late hour—is it the right time for them to act or for them to miss out?

Member discussion