In India quick commerce is becoming a flashpoint of interest, and Reliance Retail is regenerating its campaign through JioMart to target the leaders of the field such as Blinkit, Zepto, Swiggy Instamart, and Tata BigBasket. Reliance has had to develop a novel strategy to win their customers' hearts this time — one which is built on their already potent retail network and is now combined with a 30-minute delivery option.

The initiative is on its way to changing the currently over-aggressive instant delivery market of India. This article has been written to demonstrate the different plays that Reliance JioMart has made, the problems it is facing in this journey, and its likelihood of molding India's quick commerce space which is in transition.

What Quick Commerce Is and Its Importance

The term 'quick commerce' or 'q-commerce' stands for ultra-speedy delivery of products that is ideally made within 10 to 30 minutes to fit the instant demands of young consumers, in particular millennials and Gen Z.

The idea has seen overwhelming acceptance in India, with the online grocery market set to hit $11 billion in gross order value (GOV) for FY24. As declared by Goldman Sachs, about $5 billion, which means almost 50% of the total, was brought in by quick commerce alone.

The gradual shift to instant delivery is also responsible for local kirana shop customers' base erosion; this naturally leads to a new age of buyer behaviors, where the services of speed and ease in shopping are mostly relied upon. Blinkit seems to continue as the top player, having a market share of 40-45%, and is being shadowed by Zepto and Swiggy Instamart.

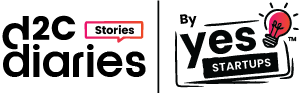

Thus, in this clearly risky situation, Reliance JioMart stands as the most suitable candidate to gain back the power as it is still trading off its fiasco of the past JioMart Express which was a complete washout in 2023 due to unviable unit economics issues.

JioMart’s Hybrid Approach: A Unique 30-Minute Model

While competitors mainly rely on the dark store model—stores that are delivery-only and very small, specifically located in neighborhoods to time deliveries for 10 minutes—Reliance JioMart intends to rely on its sprawling network of over 18,000-20,000 stores and fulfillment centers across India.

To enhance this, it has its partner ecosystem that includes around 20 lakh kirana stores who have joined the JioMart Partner initiative, which will make Reliance the main source of products and also the additional delivery force.

The new model is a perfect alternative as the company that maintains it avoids incurring the high costs related to the setup and running of dark stores and still, consumers will benefit from a delivery time of 30 minutes.

Reliance is of the view that this time frame matches the preferences of consumers who would rather have a greater range of product options and comparatively cheaper prices, even if it takes slightly longer than 10-minute ultratech solutions.

The initial stage of the service will be focused on grocery deliveries not long before it will cover many other categories like fashion and tech. The branded service called JioMart Express, as an inside source has said, is going to be the first to show up as early as next month in eight big cities, for instance, Delhi-NCR, Mumbai, Bengaluru, Chennai, Pune, Hyderabad, and Kolkata only, with a view to eventually expanding to over 1,000 cities nationwide.

Competitive Edge: Why Reliance Could Disrupt the Market

Reliance Retail’s quick commerce comeback is powered by five of the most compelling factors currently at their disposal:

- Enormous Scale and Infrastructure: Reliance toping 19,000 stores and being everywhere from the countryside to the big cities, makes them the logistics leader and puts them ahead of all their competitors.

- Supplier Bargaining Power: Due to its size, Reliance is able to have good relationships with suppliers to get competitive prices and as a result better margins. The exclusively quick commerce players can hardly reach the above.

- Financial Resources: While young companies like Blinkit are trying to find a way to be profitable, Reliance Retail has already made a profit and is actively implementing its expansion strategy. This financial stability that the company has achieved enables it to invest in quick commerce without the expectation of instant returns.

- Reliance Retail's Theme: The present visitor flow through the stores of the company and customer satisfaction are leverage points that may be the channels for transforming walk-in shoppers into online quick delivery users and particularly in cases of market demand growth for home delivery.

- Not a Friendly Infrastructure: The stores' low quality of quick pick-and-pack logistics goes against the small size of the local shopping centers and these are the primary drawbacks and the cabinets would only benefit from being the local pick-up points.

- Operational Complexity: Meeting customers who come in while filling online orders with the same products causes inaccuracies in stock and long waits resulting from e.g. bad coordination between online/offline retail and real-time off-site inventory.

- Competitive Pressure: Blinkit, Zepto, and Swiggy Instamart are already strong in the market and have developed delivery logistics and a seamless UX design. Reliance, being the last to join the market, will have to play catch-up more quickly by staying innovative and entering other fields.

- Delivery Speed Expectations: Still, while Reliance’s recent study of consumers" "said, showed, and etc. has conveyed to the company that a 30-minute window is the maximum timeframe the buyers are willing to wait, the speed of the market is led by 10-15-minute deliveries. Providing fast-paced delivery painlessly and efficiently is especially difficult without the implementation of dark stores in the hybrid model.

Impact on the Whole of Indian Retail and FMCG

The focus of Reliance's rapid commerce and delivery is not to compete with startups, but to establish the next generation of retail in India.

With e-commerce predicted to reach 30% by 2023-2024 and increase, quick commerce is expected to become FMCG's major channel. Reliance is best positioned to give discounts, obtain items in bulk, and manage margins if it has tight supplier ties.

Reliance's greater presence in the rapid commerce sector outside the major eight cities to Tier-2 and Tier-3 cities changes the industry and customers. The seamless integration of digital and physical shopping experiences by Reliance will provide real-time delivery access for all Indians or a localized notion. This will help Reliance advance Indian retail.

Rumors of speedy delivery may affect smaller rivals by naturally pushing them out and sometimes even more swiftly taking their spot. Notably, Walmart is pursuing rapid delivery via Flipkart and numerous subsidiaries. This suggests a collision in the current retail sector as more businesses compete to win market share.

Bottom Line: Can Reliance Turn The Table On the Sector? The Industry's Dependence on the Company's Breakthroughs

Reliance JioMart has made a daring and a potentially game-changing move through its re-entry into quick commerce featuring a 30-minute, hybrid delivery model. By virtue of its widespread retail outlets network, economic power, and supplier influence, Reliance has the potential to compete with the leaders of the market such as Blinkit and Zepto.

Success is under the condition of errorless execution, from the synchronization of inventory to the management of the operational complexity, to deliver a consistently superior customer experience, as one industry guest stated.

As per the industry analysts of the sector, the next several quarters are going to be crucial. By abridging the operational gaps and capitalizing on its scale, Reliance will be able to put its strategy into practice and hence potentially turn the scales of the quick commerce in India’s favor.

Member discussion