Imagine that Swiggy Instamart Q4 whirlwind has simply become a modern-day fable, with dark store, snack quests, and loads of math-induced drama.

Has Swiggy Instamart Lost Its Delivery Dominance After the "Board" of the Financial Quarter?

The Scene of Dark-Store Expansion

King Swiggy of Quick-Commerce reached out for his wizard advisor team — Bolt, Snacc, Pyng — to present to his subjects the noble “Instamart 10-minute project.

Their charge? Transport the grocery by air so the entire domain would be brimming with it instantly!

The Dark-Store Rush

In just three months, the nation was enriched by 316 innovative dark-stores — of course, this is greater than the combined accomplishments of the past two years and it happened in just five weeks — remarkably, their total number became 1,021 in 124 cities .

By adding over 62%, they became the biggest party in town, playing with innumerable squares of their competitors—Blinkit and Zepto were simply for a little pass time.

The Glowing GOV Empire

The key revenue drivers were:

Instamart’s Gross Order Value (GOV) almost doubled YoY and was ₹4,670 cr.

Surely, Swiggy platform had GOV of ₹12,888 cr, a considerable uplift of around 40% YoY. Voice tellers and cars all flyers and the like people ... in the disco yes really, the ponds, they are dead. These are they stamped over matches in the dark.

But How The Profit Business Skyrocketed

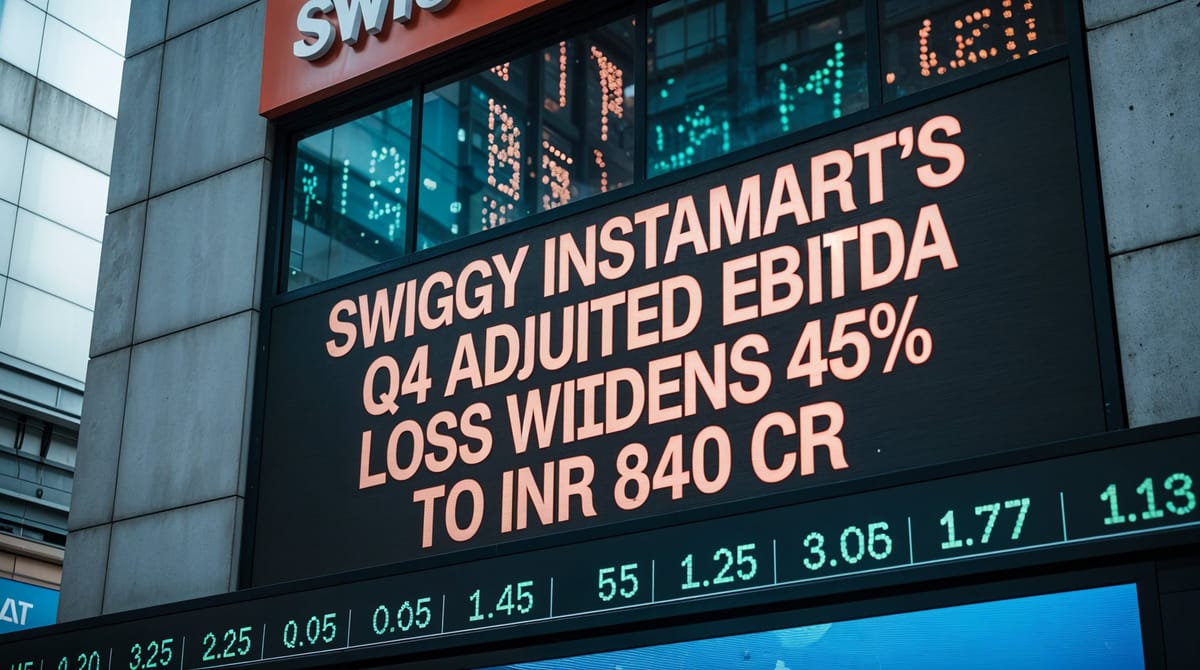

The cost of the expansion had a 45% increase from Q3’s ₹578 cr to ₹840 cr in Adjusted EBITDA losses that is virtually a vampire-like amount and a 174% surge from ₹307 cr YoY .

Was it due to a higher cost of sales, or to the impact of acquisition or stock due to the surge in sales? The net loss? A staggering ₹1,081 cr—nearly twice the amount compared to the loss of the previous year—despite all the noise in the city.

The Characters & Their Missions

- Swiggy Instamart

The knight in shining armor embarking for the 10-minute grocery delivery quest — with marketing sorceries and new branches. Yet its defense, i.e., the contribution margin, has gone down to -5.6% due to redundant launch pads and extremely generous offers.

- 10-minute grocery delivery

They could perform magic with their advertising and the new ventures as well as open supermarkets in a new location that could cover the area. Nevertheless, their armor referred as the contribution margin saw a reduction of 5.6% mainly because of the launch pads which were not fully utilized and the huge incentives spent.

- Food‑Delivery: A Trusted Squire

On the other hand, the Swiggy's main core, that is the food delivery sector, was left intact. The Gross Order Value (GOV) was up by 17.6% in a year and the business yielded a profit, too—₹212 cr adjusted EBITDA which corresponded to a healthy 2.9% margin. Of the total ordered food, Bolt served 12% of all food orders hence the strength of the team continued.

- Out‑of‑Home: The Surprise Jester

It's a turn of the situation on its head! The ventures in the dining-out line of business found opportunity and e—0.3% EBITDA margin—indicated operating profit for the first time.

The Moral of the Quick‑Commerce Quarrel

Each point is definitely trending, so it is a good cause for joy.

- But one thousand and twenty-one dark-stores? We are in trouble because they cost a lot, at the beginning, especially, when no profits are made.

- The country has lost ₹732 cr from the platform EBITDA, ₹840 cr from Instamart, and the net loss is a whopping ₹1,081 cr.

- Though the statement above defines that the leaders are expecting the losses to stop, they also express the Q4 as the phase when the losses “reached their peak” and indirectly stated that there would be a revival around 3–5 quarters later.

The Quirky Cliffhanger

Imagine a situation where a dark store-instant mass-a great mob appeared in the middle of a quiet town. Local people kept looking at them in amazement. Simultaneously, delivery drones from Instamart served the best avocado toast in only 10 minutes.

It was a fantasy, though still, the state's fund is in a rotten state. People who are obviously satisfied with the convenience are asking, "When will we have to pay the piper?" so quietly that no one else can hear them.

And They Lived… Hopefully Profitably Ever After

Could dark stores that were hitherto lying fallow leap into action again pretty soon?

Is it possible for users to place their orders at a frequency that keeps the quantity of goods moving down to the level necessary without running out of energy? For example, is there a possibility of them being energized by the offer of an exclusive voucher on their next refill?

How many dragons more must be they fight in the war with Blinkit, Zepto, and BigBasket to be the winners of the market?

Member discussion