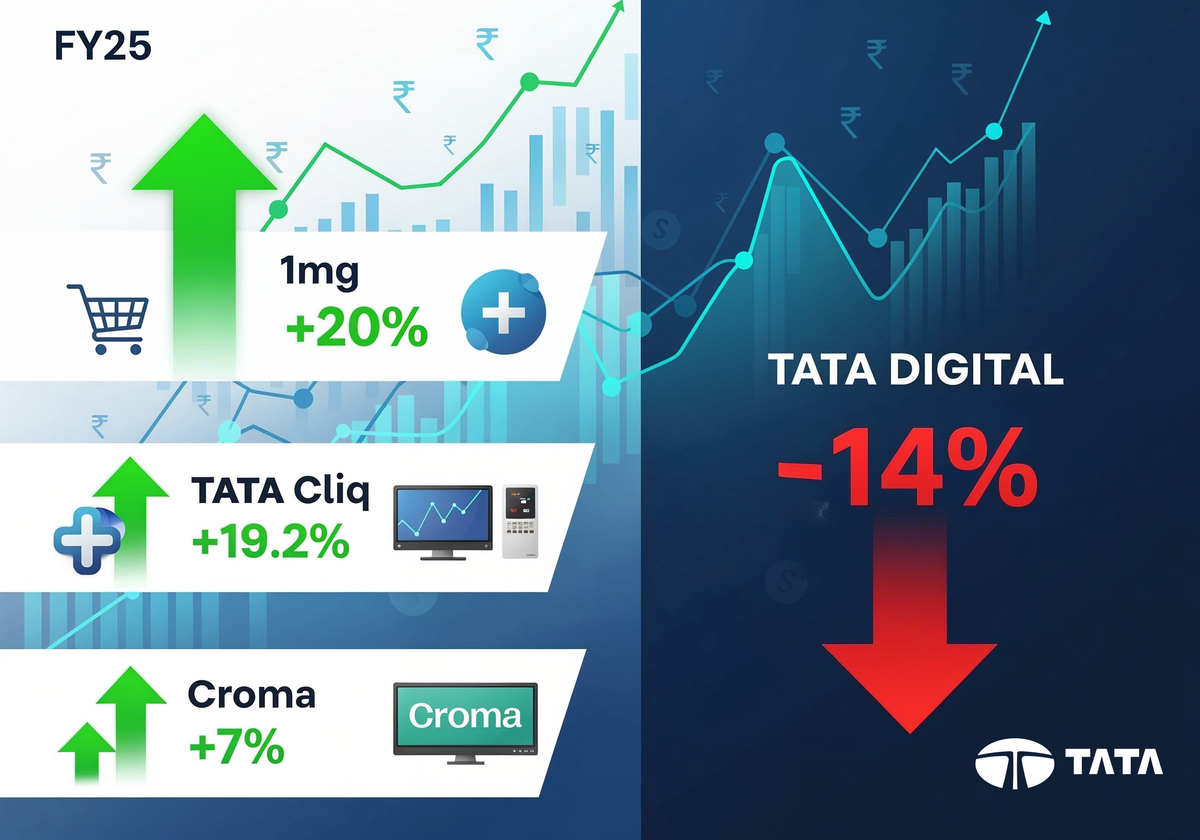

In the same firm, Tata Digital, the student's ambitious e-commerce branch, relays mixed financial results for the 2025 business year. The group's healthcare flagship, Tata 1mg, has managed to achieve excellent operational revenue growth of 20%; nevertheless, the overall holding company has recorded a decrease, thus indicating that the group is going through a pricey but regulated strategic transition.

The Holding Company's Calculated Retreat: A 14% Dip in Turnover

Disclosed financial statements and other data indicate that Tata Digital Ltd., the parent company of the likes of Tata 1mg and Tata Neu, and other digital initiatives, was the total revenue earner for the Indian economy with around ₹2,573 crore in FY25. This is 14.1% less than the total revenue of the previous fiscal year, which stood at just under ₹2,995 crore.

The decrease is not necessarily a sign of trouble, as the company has been implementing a new business model. The management has been working to achieve a more productive use of resources to stop the practice of running large promotional campaigns and incurring customer acquisition costs, which are usually targeted at the Tata Neu super-app.

Consequently, the holding company has been less exposed to the market and hence the company's short-term decrease in gross merchandise value (GMV) and revenue, while the most mature asset goes on its upward trajectory.

Tata 1mg: The Unwavering Engine of Growth in a Rebuilding Phase

While the parent company overstretched to deliver enough revenue for the top line, Tata 1mg Technologies stood tall to bolster one of the digital assets leaders of the Tata portfolio. The healthcare platform executed a fantastic performance of 20% year-on-year operating revenue growth for FY25. The rise of 1mg is multilateral: it is by the enlarged user base, deep penetration of pharmacy and diagnostics vertical, and the increase of average basket as consumers' health and wellness priority post-pandemic keeps on holding back their heels.

Re-entering the Investment Zone: Fueling the Next Growth Chapter

Among the many tales that the reports reveal, one of the most striking is Tata 1mg's deliberate decision to "go back to an investment phase." After a period of about two years when the company was mostly concentrating on unit economics and path-to-profitability, it is now taking fresh steps with full energy to make use of the growth levers. The company is doing the following:

- Geographical Expansion: Not only to open new branches in the Tier-II but also in the Tier-III cities, where the need for an online healthcare that can be trusted is going up at a rapid pace.

- Supply Chain Fortification: Increasing the capacity of the warehouse and equipping it with cold chains to ensure that the delivery of medicines, especially the temperature-sensitive ones is very fast and reliable.

- Tech and AI Integration: Lubricating the use of artificial intelligence in their platform for better and more targeted health recommendations, stock control, and customer service.

- Portfolio Diversification: Adding to the range of products and services related to chronic disease management, premium wellness products, and telemedicine consultations.

It has been very well illustrated by the refreshed investment how the change from revenue and simultaneously marketing and operational expenditures moving upwards has been done.

The Neu Frontier: Streamlining for a Sustainable Future

Tata Neu super-app, the parent of 1mg, is going through a radical change and 1mg is benefitting from it. The new strategy approach elements are, first, the temporal aggressive customer acquisition through deep discounts, and second, the engagement of customers based on the solidity of the relationship built through sustainable means.

- Loyalty Integration: The main point is to completely assimilate the ontology of the Tata Neu Pass loyalty program into the entire Tata universe so as to generate loyalty, which means, repeat purchases without any additional effort on the customer's part, probably the main objective of the loyalty program.

- Seamless UX: Mainly, the application will take the responsibility of repairing the software part of the user experience, which will then be smoother.

- Superior Brand storytelling: Leveraging the loyalty of customers that stems from being one of the members of the Tata stable of brands rather than solely trying to be competitive through pricing.

The Road Ahead: Profits vs. Scale in the Digital Arena

One more time it appears that the discord between the narratives of Tata Digital and the mood questioning the classic dilemma of modern e-commerce: the balance between growth and profitability. For now, Tata seems to be running a two-front operation:

- Profit-Centric Growth (Tata 1mg): The main idea is to start a business and turn it into a more mature one regarding revenue that will generate more cash and more than half of it will be reinvested so as to take a leading position in the online healthcare market which is assumed to be very promising.

- Sustainable Rebuild (Tata Neu): Instead of going through the back door to lower cash burns and to remain as a super-app, a deliberate decision to reconstruct the business model to be the most viable one for the long term is made and hence the step back is an important part of the strategy.

Market analysts believe that Tata Digital's financial figures for 2025 should be seen as a transition rather than anything else. The decrease in the total turnover will be the price that will have to be paid to create a digital empire that is more secure and economically reasonable.

The turning to this bold change will rely heavily on 1mg's ability to turn its revenue growth into market leadership and on the ability of Tata Neu to create a distinctive identity that is not dependent on discounts.

Member discussion